Archives: News

London, UK – June 25th, 2024 – iibanks is thrilled to announce that Mr. Sohail Sultan, CEO of iibanks, has been Awarded CEO of the Year in the Finance Industry by European CEO. This prestigious recognition underscores Mr. Sultan’s exemplary leadership, vast experience, and significant contributions to the financial sector.

The judging panel at European CEO was particularly impressed with Mr. Sultan’s extensive and distinguished career in the financial services industry. Sohail has 30 years of experience in financial services, acquired at leading multinational financial institutions.

“I have also been asked to pass on to you that in doing their due diligence and making their final decision, the judging panel were immensely impressed with Mr. Sohail Sultan in multiple ways,” the European CEO panel stated.

“Firstly, with Mr. Sohail Sultan’s immense and impressive high-level experience within the financial services sector, including starting his career at Citibank here in London, and subsequently reaching the position of not only the Head of Global Product Development for Financial Institutions but also the Head of Structured Finance for the Asia Pacific.”

Beginning his career at Citibank in London, Mr. Sultan quickly rose through the ranks to become the Head of Global Product Development for Financial Institutions, Head of Structured Finance for the Asia Pacific, and Head of Cross Border European Structured Product Arbitrage within six years. His roles included managing processes and risks, driving revenue, innovating products, and executing deals across Europe, the Americas, Africa, and the Far East.

Subsequently, Mr. Sultan worked at Barclays Capital in London for nine years, holding senior positions, including Managing Director. During his tenure, he was responsible for expanding the company’s Structured Capital Markets business beyond the UK into North America, Europe, and Asia Pacific.

Following his time at Barclays, he provided advisory services for private equity infrastructure projects in South Asia, the Middle East, and the UK at Cobussen and Partners, developing a portfolio of structured investments with private and institutional investors.

“The judging panel were also delighted to know that Mr. Sultan, in his 30 years of experience, has held senior positions at Barclays Capital, including Managing Director, along with working at Cobussen and Partners, where he provided expert advisory services,” the statement continued.

The panel highlighted Mr. Sultan’s continued demonstration of leadership, his achievements, and his ambition for iibanks’s expansion as crucial factors in their decision. “From the judging panel’s point of view, the leadership Mr. Sohail Sultan continues to demonstrate combined with his experience, achievements, and ambition for the group when it comes to expansion were important factors that the other shortlisted candidates could not compete with.”

This recognition by European CEO is a testament to Mr. Sultan’s dedication and the innovative spirit he brings to iibankss. His leadership has been pivotal in driving the company’s growth and success in an increasingly competitive financial landscape.

‘SOS Children’s Villages, in São Domingos, have managed, in recent years, to improve food, education and health conditions for the children they host, with the support of the international investment bank (iib), which granted a social obligation in more than Three million esucodes.’

Through the social obligation “iib Solidary Indexed Bond Series B (2.95% + SOS) – 2022 | 2024”, the bank has contributed to the financial stability and well-being of the at-risk communities supported by the organization, in particular Aldeia SOS de São Domingos, in Santiago, as stated in a statement.

“The iibCV social obligation was issued with the aim of allocating part of the remuneration of the funds to Aldeia SOS de São Domingos, contributing to supporting the organization with essential expenses, including family, educational and health expenses”, he points out.

31% of essential expenses

The amount made available, according to the same source, corresponds to 31% of the annual budget for essential expenses of Aldeia SOS de São Domingos, in a total of 3,200,000 CVE, of which, by September 2023, 705,905 CVE had been used, the which corresponds to 22% of the total value.

“The amount made it possible to improve the housing conditions of one of the houses in Aldeia SOS de SãoDomingos, as well as support family expenses – food, cleaning, clothing and operational expenses –, education and health”, states the bank.

Huge impact

Alcides Moreira, director of Aldeia SOS São Domingos, recognized the importance and success of this initiative, with immediate and long-term effects.

“The impact of the support granted by iibCV is enormous and with immediate and medium-term effect, allowing us to improve our children’s nutrition, provide different holidays, with the opportunity to attend the Cesária Évora arts academy, among other activities”, listed the responsible.

Along the same lines, he added, it was possible to pay for transport for the children to carry out activities in partnership with the University of Cape Verde, as part of their participation in the Uni-CV kids program.

Studies in Portugal

“This support also allowed, in the last quarter, six more of our young people to continue their studies in Portugal. It was also possible to improve the conditions of one of our homes, improving the reception of our children and young people”, he said.

The impact of the Social Bond, according to iib’s director of Human Capital and Social Responsibility, Leida Semedo, reflects the bank’s “commitment to sustainability and social responsibility, with a special focus on the well-being of children and young people in Cabo -Green”.

On March 1st, iib West Africa opens a new service point at the Cape Verde Post Office in Espargos, on Sal Island.

“This moment is the result of a solid and promising partnership, the result of a Protocol signed between these two institutions. The agreement aims to establish commercial partnership relations between the parties and provides that Correios de Cabo Verde, at branches in Mindelo, Praia, Espargos and Santa Maria, on behalf of the iib West Africa, will provide parabank services, namely through the provision of of a physical space where iib West Africa can install a platform to access banking services via electronic channel”, says the bank in a press release.

The inauguration ceremony will be attended by members of the executive team from both companies.

This new post, according to the same source, will allow the movement/compensation of balances via Deposit and Withdrawal; Deposits and withdrawals, even if above the available limit, subject to prior notice and authorization by the iib; Possibility of requesting and delivering debit and credit cards to the Post Office counter; Possibility of initiating the account opening process with collection of documentation, the physical process, physical and digital sending of the process to the iib and receipt of checks for deposit into the iib client account: Posting (captive) until receipt of the physical check at the head office from iib.

The United Nations Global Compact SDG Ambition 2023/24 program has already kicked off, with a fantastic group of companies that over the next few months will set ambitious business goals and accelerate the integration of the 17 #SustainableDevelopmentGoals (SDGs) into their management and strategy.

SDG Ambition is an 8-step program that begins with a maturity analysis and identification of priority #impact areas and progresses through the definition of ambitious objectives, implementation paths and actions, metrics and innovative opportunities for the technological and business integration of #ODS, ending with a complete and time-bound Action Plan.

The United Nations Global Compact Network Portugal welcomes this year’s companies and Participants, who over the next 6 months will work to bring their organizations.:

- Greater alignment with the #ODS and a #sustainability strategy aligned with the company’s practices and priorities

- Improved performance, through the identification of new opportunities, better risk management and alignment with the market

- More innovation

- Greater resilience

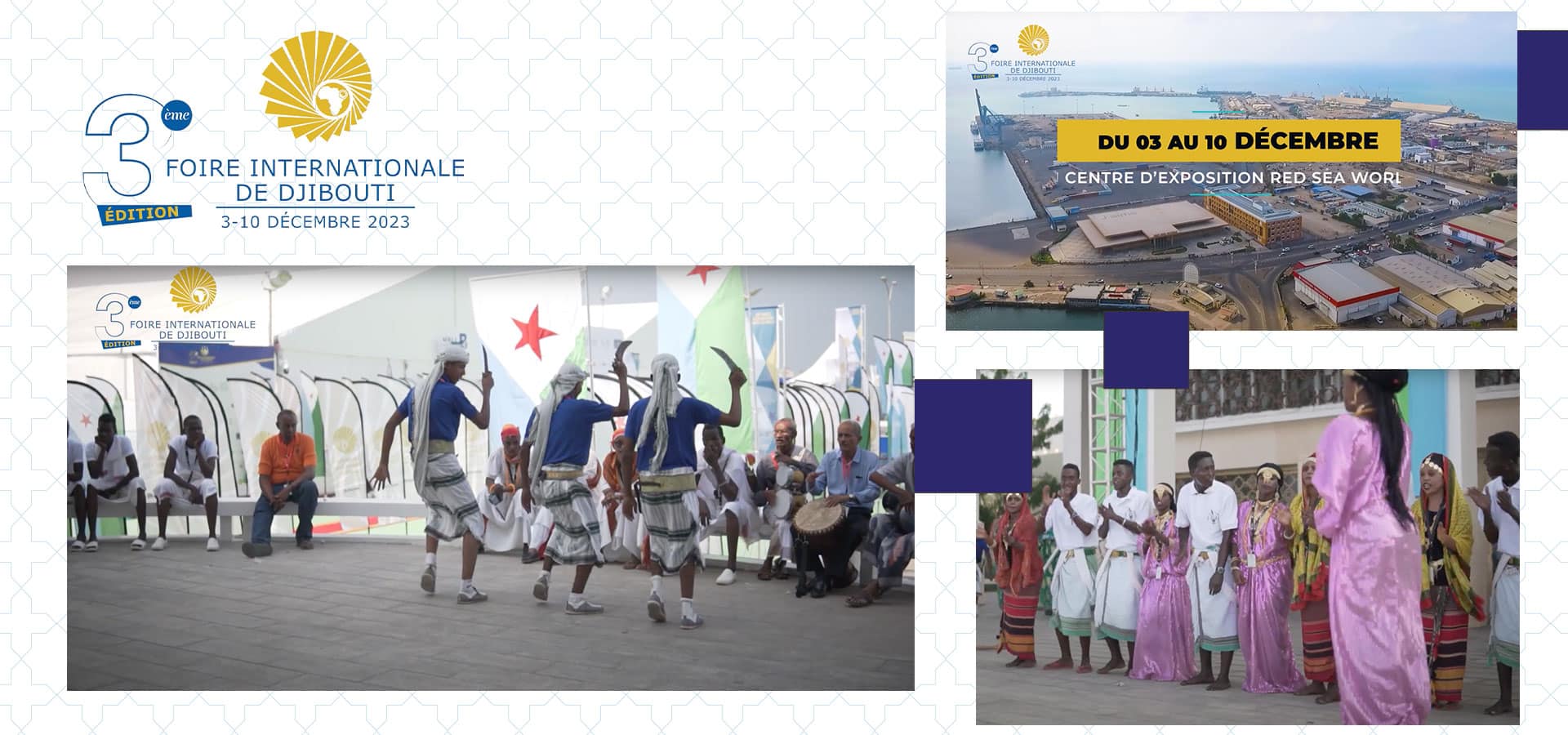

iibanks took center stage at the Djibouti International Fair, Red Sea Exhibition, from December 3rd to 10th, presenting two captivating attractions that defined its participation at the event.

The main attraction of the event was the live Millionaires Draw, a riveting affair hosted by Djibouti’s own celebrated influencer, Omyreen. Attendees witnessed the excitement unfold as winners were announced, adding an element of thrill to the trade event.

In addition to this, iibanks showcased technological innovation with a thrilling VR experience featuring the #iib Millionaire’s Safe. Attendees were immersed in a virtual journey provided by iibanks at their stall. This dynamic presentation emphasized iibanks’ commitment to pushing the boundaries of traditional banking.

The event drew the attention of esteemed guests, including the Ministry of Education and the President of the Chamber of Commerce, who visited the #iib stall, acknowledging the bank’s active participation and innovative offerings at the exhibition.

Discover the successful journey of iib Cabo Verde from a small subsidiary to becoming one of the reference banking institutions in the archipelago.

History

The international investment bank, SA began its activity in the Cape Verdean market in July 2010 as a financial subsidiary entity wholly owned by Novo Banco (NB). In 2018, as part of its acquisition strategy, iibGroup acquired 90% of BICV’s capital, maintaining NB as a reference shareholder.

A year later, iib Cabo Verde (iibCV) was ‘born’ with very clear objectives: to contribute to the development of the local financial sector, importing the industry’s best practices into the country, in order to compete not only locally, but globally . This initiative was seen as a way of giving back to society, working closely with local communities, empowering them and providing better opportunities, in line with the Group’s philosophy: “Transforming Lives.”

Route and Recognition

Absa Africa Financial Market Index 2023

Commitment to Society and Sustainability

In this exclusive interview, the Chairman of the Board of Directors of the International Investment Bank (iib), Sohail Sultan, talks about how the focus is to continue to grow the African franchise, because he believes that there are huge opportunities to build a regional financial institution focused on facilitating and financing regional trade. As for Cape Verde and operations in West Africa, the emphasis on the future will increasingly be to try to position the institution to capture, support and manage many of these regional financial transactional flows.

Being the only finalist who has a physical presence in Cape Verde, do you consider this an advantage?

What are the main challenges they anticipate in relation to this acquisition and how do you expect to overcome them?

“The banking sector continues to go through a challenging time, but, as a small group, we continue to grow reasonably well, especially given the complexities of the markets in which we operate.”

iib has been certified as a Great Place to Work® in Bahrain. After conducting a survey among colleagues, iib ranked extremely high on all parameters, from workplace culture to collaboration, from open-door policy to teamwork and

camaraderie.

iib ranked iib ranked 100% on the following:

• This is a physically safe place to work.

• People here are treated fairly regardless of their gender.

• Taking everything into account, I would say this is a great place to work.

• People here are treated fairly regardless of their age.

• People celebrate special events around here.

Speaking on the occasion, CEO Sohail Sultan said, “We are committed to continuing this extremely positive trend and creating an exemplary environment for all our colleagues. I want to express my appreciation and thanks for your contributions. Let’s celebrate this achievement together and continue to uphold our values as we move forward. It is an honor to lead such a remarkable group of individuals.”

iib congratulations the entire team on this tremendous milestone.

About Great Place To Work®

Great Place To Work ® (www.greatplacetowork.me) is the global authority on high-trust, high-performance workplace cultures. Through proprietary assessment tools, advisory services, and certification programs, Great Place To Work ® recognizes the Best Workplaces™ across the world in a series of national lists including those published by Fortune magazine (USA) and in leading media across the Middle East. Great Place To Work ® provides the benchmarks, framework, and expertise needed to create, sustain, and recognize outstanding workplace cultures.